It is an all inclusive paid event with many

notable speakers from the Financial Services industry. It also includes a

charitable component. Event dates are November 6-8, 2015 and it is being

held at the Mayfair Hotel and Spa in Coconut Grove.

Thursday, October 29, 2015

Wednesday, October 28, 2015

It’s Better for Millennials to Buy Than Rent—For Now (BusinessWeek)

In 98 of the biggest 100 U.S. metros, young workers are better off buying a house than renting one.

Is it better to rent or buy?

It’s an old parlor game and, in recent years, a source of frustration for young workers. Low interest rates and home prices knocked down from the housing crisis have made buying a much better deal than renting in virtually all U.S. markets. But good deals notwithstanding, buying is an option only for those who earn enough to afford the homes available on the market.

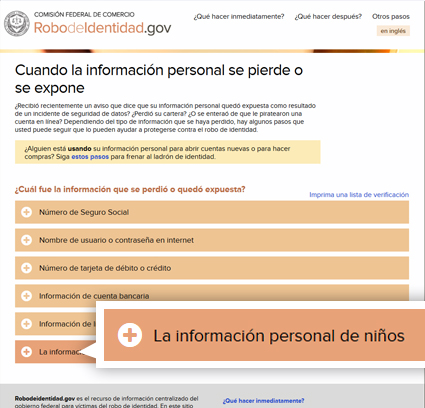

A report from Trulia on Tuesday offers some hard solace for would-be homebuyers priced out of hotter housing markets. Across the U.S., the report said, it’s 23 percent cheaper for a young household to buy a home than to rent one. But in San Jose and Honolulu the advantage to buying is nonexistent. In New York and other expensive cities, the advantage to buying will likely disappear once mortgage rates finally rise.

Trulia compared the median costs of buying and renting and found that San Jose and Honolulu are the only two U.S. cities where renting is a better deal.

Trulia’s researchers factored in down payments, property taxes, security deposits, and other costs, as well as expected home price and rent appreciation, when comparing renters and buyers. They assumed for their analysis that millennial buyers can afford to put just 10 percent of the sales price as a down payment, and that they’ll stay in the home for only five years.

While Trulia’s rental data extend back only to 2012, Ralph McLaughlin, a housing economist at the company, says you probably have to go back to the 1980s—when mortgage rates hung out in the double digits—to find a time when renting won out over buying in most U.S. cities.

Rising rents may make the outlook bleak for young workers in many big cities, but renting is going to look better compared with buying as interest rates rise.

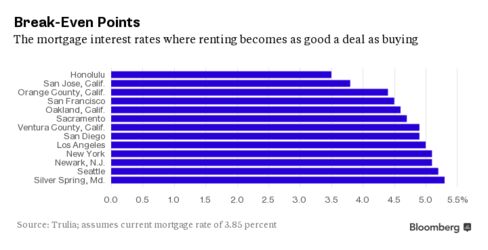

Meanwhile, here are the metros—mostly in the South and Midwest—where buying a home instead of renting proffers the biggest cost savings.

Tuesday, October 27, 2015

APHIS Final Rule (Florida Customs Brokers & Forwarders Association)

|

|

|

Monday, October 26, 2015

Reverse Mortgage Disadvantages and Advantages

Your Guide to Reverse Mortgage Pros and Cons

For many people, a Reverse Home Mortgage is a good way to increase their financial profile in retirement - positively affecting their quality of life. And while there are numerous benefits to the product, there are also some drawbacks.

Reverse Mortgages are providing improved financial security, a better lifestyle and real financial relief to thousands of older Americans. However, there are some disadvantages.

Disadvantages of a Reverse Mortgage include:

High Fees: The upfront fees (closing and insurance costs and origination fees) for a Reverse Mortgage are considered by many to be somewhat high – marginally higher than the costs charged for refinancing for example. However, the fees are financed by the Reverse Mortgage itself so nothing is paid out of pocket. Furthermore, recent changes to the HECM Reverse Mortgage reduced some of the fees.

For more information on the fees charged on Reverse Mortgages, consult the Reverse Mortgage rates and fees article.

Also, if fees concern you, try talking to multiple Reverse Mortgage lenders – you may find a better deal from one over another.

Accumulating Interest: There are no monthly payments on a Reverse Mortgage. As such, the loan amount – the amount you will eventually have to pay back -- grows larger over time. Every month, the amount of interest you will eventually owe increases – it accumulates. However, the amount you owe on the loan will never exceed the value of the home when the loan becomes due.

Most Reverse Mortgage borrowers appreciate that you don’t have to make monthly payments and that all interest and fees are financed into the loan. These features can be seen as disadvantages, but they are also huge advantages for those who want to stay in their home and improve their immediate finances.

Not Enough Cash Can Be Tapped: If you have a lot of home equity, you might be frustrated that a Reverse Mortgage only enables you to use some of it. The HECM loan limit is currently set at $625,500. However, your actual loan amount is determined by a calculation that uses the appraised value of your home, the amount of money you owe on the home, your age and current interest rates.

It’s Complicated: A Reverse Mortgage is a mortgage in reverse – that can be hard to get your head around. With a traditional mortgage you borrow money up front and pay down the loan down over time. A Reverse Mortgage is the opposite – you accumulate the loan over time and pay it all back when you are no longer living in the home.

The basics of Reverse Mortgages can seem so foreign to people that it has actually taken many financial advisors and personal finance gurus some time to understand the product. Many experts shunned the product early on thinking that it was a bad deal for seniors – but as they have learned about the details of Reverse Mortgages, experts are now embracing it as a valuable financial planning tool.

Advantages of a Reverse Mortgage

The main advantage of Reverse Mortgages is that you can eliminate your traditional mortgage payments and/or access your home equity while still owning and living in your home. Given the right set of circumstances, a Reverse Mortgage can be an ideal way to increase your spending power and financial security in retirement.

Key advantages and benefits of Reverse Mortgages include:

Stay in Your Home and Improve Your Immediate Finances: The key to a Reverse Mortgage is that it enables you to live in your home for as long as you want with absolutely no monthly mortgage payments and – in many cases – you can also get access to money to use for any purpose.

Flexibility: The Reverse Mortgage is a tremendously flexible product that can be utilized in a variety of ways for a variety of different types of borrowers. Households who have a financial need can tailor the product to de stress their finances. Households with adequate resources might consider the product as a financial planning tool.

Low Risk of Default: Unlike a home equity loan, with a Reverse Home Mortgage your home can not be taken from you for reasons of non-payment – there are no payments on the loan until you permanently leave the home. However, you must continue to pay for upkeep and taxes and insurance on your home. (Furthermore, you may be subject to foreclosure if you live somewhere other than the home longer than allowed by the loan agreement.)

The Reverse Mortgage Lenders have no claim on your income or other assets.

No Downside: With a Reverse Mortgage you will never owe more than your home's value at the time the loan is repaid, even if the Reverse Mortgage lenders have paid you more money than the value of the home. This is a particularly useful advantage if you secure a Reverse Mortgage and then home price declines.

Tax Free: As a Reverse Mortgage is a loan, the money from it is typically tax-free, whether you receive it as fixed income or in a lump sum.

No Restrictions: How you use the funds from a Reverse Mortgage is up to you - go traveling, get a hearing aid, purchase long term care insurance, pay for your children’s college education, or simply leave it sitting for a rainy day - anything goes.

Flexible Payment Options: Depending on the type of loan you choose, you can receive the Reverse Mortgage loan money in the form of a lump sum, annuity, credit line or some combination of the above.

Home Ownership: With a Reverse Mortgage, you retain home ownership and the ability to live in your home. As such you are still required to keep up insurance, property taxes and maintenance for your home.

Guaranteed Place to Live: You can live in your home for as long as you want when you secure a Reverse Mortgage.

Federally Insured: The Home Equity Conversion Mortgages (HECM) is the most widely available Reverse Mortgage. It is managed by the Department of Housing and Urban Affairs and is federally insured. This is important since even if your Reverse Mortgage lender defaults, you'll still receive your payments.

Can Increase Your Wealth: Depending on your circumstances, there are a variety of ways that a Reverse Mortgage can increase your wealth. Some financial planners are recommending Reverse Mortgages to:

Preserve and increase the value of your home equity: If you take your loan amount as a Home Equity Line of Credit, then this money accrues interest – the bank pays you interest. This locks in a portion of the value of your home equity and might grow it faster or more certainly than increasing real estate values.

Maximize wealth: Personal finance can be complicated. You want to maximize returns and minimize losses. A Reverse Mortgage can be one of the levers you use to maximize your overall wealth.

Beyond Advantages and Disadvantages, Reverse Mortgages Are Not for Everyone

While the following are not strictly disadvantages, it is important to remember that a Reverse Mortgage may not be for everyone, consider the following:

Beware if You are Eligible for Low-Income Assistance: If you are currently or will be eligible to receive low-income assistance from the Federal or State government (like Medicaid), you will want to be careful that income from a Reverse Mortgage does not disqualify you from that assistance. (NOTE: Social Security and Medicare are not impacted by a Reverse Mortgage.)

Reconsider if You Are Planning to Move in the Near Term: Since a Reverse Home Mortgage loan is due if your home is no longer your primary residence and the up front closing costs are typically higher than other loans, it is not a good tool for those than plan to move soon to another residence.

Evaluate if You are Willing to Reduce Your Heirs Inheritance: Many people dismiss a Reverse Mortgage as a retirement option because they want to be sure their home goes to their heirs. And it is true, a Reverse Mortgage decreases your home equity - affecting your estate. However, you can still leave your home to your heirs and they will have the option of keeping the home and refinancing or paying off the mortgage or selling the home if the home is worth more than the amount owed on it. There are numerous potential Estate and Retirement Planning benefits to a Reverse Mortgage - see Innovative Uses of a Reverse Mortgage for more information on these options.

What Do You Think? Do the Advantages Outweigh the Disadvantages?

Studies indicate that more than 90 percent of all households who have secured a Reverse Mortgage are extremely happy that they got the loan. People say that they have less stress and feel freer to live the life they want.

Learn more about the fees associated with a Reverse Mortgage or instantly estimate your Reverse Mortgage loan amount with the Reverse Mortgage Calculator.

Thursday, October 22, 2015

Tuesday, October 20, 2015

Tu vida en línea después de la muerte

por Carol Kando-Pineda, Abogada, División de Educación del Consumidor y Negocio

(Comisión Federal de Comercio)

De acuerdo, sé que realmente no quieres hablar sobre este tema – pero igual te lo digo: todos nos vamos a morir algún día. Tal vez ya comenzaste a prever algunas cosas: la planificación de tu funeral, el cuidado de tus seres queridos y las disposiciones para legar tus propiedades. ¿Pero has pensado en tu vida en línea? Todos los archivos digitales, fotos, lo que has publicado en los blogs y otras cuentas en línea que dejes atrás pueden causar una serie de inconvenientes – incluso fraude o robo de identidad – que tus seres queridos tendrán que resolver. Te damos algunas recomendaciones para que idees un plan para tu vida en línea después de la muerte.

Enumera tus cuentas. Haz un inventario de tu vida digital, incluyendo las cuentas de email, medios sociales, blogs, juegos y archivos almacenados en la nube. Prepara una planilla u otro tipo de archivo para registrar el nombre y URL de cada sitio, tu nombre de usuario y contraseña, y lo que quieres que se haga con cada cuenta, y cualquier otra información necesaria para acceder a esas cuentas. Es posible que algunas de tus cuentas involucren dinero – dinero contante y sonante o monedas virtuales – y pueden requerir especial atención. No adjuntes tu inventario a tu testamento ya que se convertirá en un documento público después de tu muerte.

Entérate ya. En varias cuentas te permitirán hacer los arreglos ahora o nombrar a alguien para que se ocupe de la cuenta después de tu muerte. Averigua cuáles son tus opciones.

¿Quién te puede ayudar? Quizás quieras designar un albacea para que se ocupe de todas estas tareas después de tu muerte, preferentemente alguien que tenga experiencia con cuentas en línea y que comprenda cómo llevar a cabo tus instrucciones – o que pueda tomar decisiones sobre algunos asuntos que tal vez no hayas previsto. Puedes seleccionar un amigo o familiar para ser su albacea digital o se puede contratar un servicio de terceros para ayudarle.

Para más información, haz una búsqueda en internet ingresando “online life after death” o “digital” y “afterlife” o “legacy” o “executor”, si haces la búsqueda en español ingresa “vida en línea después de la muerte”, o “después de la muerte” y “digital” o “herencia” o “albacea”.

Friday, October 16, 2015

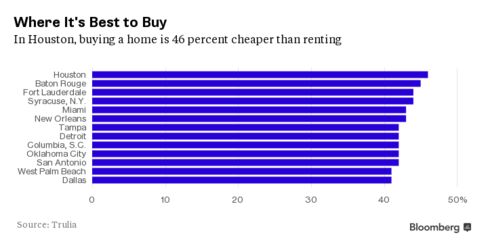

Cómo proteger la información de tu hijo...(Comisión Federal de Comercio)

|

Tuesday, October 6, 2015

How Local Governments Got Burned by Private Prison Investments (BusinessWeek)

James Parkey spent more than a decade crisscrossing the U.S. selling poor counties on a way to get rich quick. He’d help local governments issue tax-free bonds to build private prisons that would rent beds to the federal government, mainly to hold undocumented immigrants. Parkey’s model for financing lockups, which he promoted with help from a team of bond dealers, consultants, and lawyers, led to a boom in prison construction. While the jails succeeded in many places, almost two dozen defaults followed in cities and counties from Florida to Montana as the prisons struggled to fill beds amid the sudden glut. Then the IRS got involved.

As of July, eight detention center deals were being investigated over their tax-exempt financing, according to an IRS document. Several other counties in Texas and Arizona have settled with the government, paying as much as $1.9 million and refinancing their prisons with taxable debt, including at least three developed by Parkey and his network. In most cases the deals were “basically snake oil,” says Bob Libal, executive director of Grassroots Leadership, a nonprofit in Austin opposed to private prisons.

Parkey, an architect, got into the correctional facilities business in the 1970s, when Texas ordered counties to rebuild their crumbling jails. In the 1990s he founded Corplan Corrections in Irving to focus on prison design and development. “You do one, you do two, you do 10, you do 20, and I guess you’re an expert,” says Parkey, who declined to comment on tax issues. In the wake of the Sept. 11 terrorist attacks, he assembled a team to visit counties eager to kick-start their economies. It included two bond underwriters, a feasibility consultant, a Houston-based builder, and a rotating cast of private prison operators, including Emerald Correctional Management of Shreveport, La.

They provided local officials with feasibility studies suggesting the facilities would pay for themselves with rental revenue from the U.S. Marshals Service and U.S. Immigration and Customs Enforcement. Counties were urged to build jails with two to three times more capacity than they’d need for local inmates. They also were advised to act fast to nail down that business, lest they “allow other counties or private developers to capture the market,” according to a report given to prospects by Parkey’s team. Local development authorities, some created specifically for the detention deals, owned the projects and issued bonds for them whose interest was exempt from federal taxes.

The bond offering statements included a warning indicating that the IRS might take issue with the setup. They said the tax-exempt status could be “adversely affected” by the decision to house federal inmates at the jails. Since 1986, the federal use of projects built with tax-exempt bonds has been limited to 10 percent, to prevent bondholders from being paid with taxpayer dollars as well as getting the tax-free subsidy. But in 1998 the IRS allowed a single jail project to go ahead with tax-exempt financing because the federal use was intended to be short-term. Since then, developers have argued that their prisons should also qualify for tax exemption. Some have used nonrenewable short-term federal contracts to bolster their claims, according to Mark Scott, the former director of the IRS’s tax-exempt bond division. “They pushed the envelope hard,” he says.

Polk County, one of the poorest in Texas, was eager to ink a deal with Parkey. In 2004 it created the IAH Public Facility Corporation to issue $49 million in tax-exempt bonds to build a jail to house immigrant detainees. Today, hundreds of the 1,054 beds in the detention center are empty. “I trusted the people, or we wouldn’t have gone forward with it,” says Tommy Overstreet, a county commissioner who voted for the facility. “At that particular time everything was go, go, go.”

The Polk facility was initially a boon for the county, generating almost $1 million a year in revenue. Then things changed. The federal government stopped sending as many inmates amid allegations of poor medical care, insufficient food, and excessive use of solitary confinement. The population dropped further after President Obama issued executive orders in 2012 and 2015 suspending detention and deportation for millions of undocumented immigrants. In May 2014 the IRS served notice that it considered the jail’s tax-exempt financing improper. The county development authority, which has settled with creditors over $49 million in outstanding bonds, agreed in September to pay the IRS $980,000 to resolve the case.

Parkey blames the woes in Polk and other counties on circumstances unique to each prison and to dwindling immigration enforcement. “We build them, design them, help communities to get the right operator with the right use, and try to make them successful,” he says. “We’ve had good luck with that, and we’re proud of it.” The IRS declined to comment on the Polk case or any others, saying it’s prohibited by law from discussing specific taxpayers. The underwriters say their decisions were informed by attorneys’ opinions. “With regard to the tax exemption of bond issues, we rely on recognized bond counsel’s opinion that the interest on the bonds will be tax-exempt,” says William Sims, managing principal at Herbert J. Sims & Co., a firm in Fairfield, Conn., that worked with Parkey on the Polk County deal. The law firm that advised Sims, Jenkens & Gilchrist, was dissolved in March 2007 after reaching a nonprosecution agreement with the Department of Justice in which it admitted that it developed and marketed tax shelters worth billions.

In 2005 a Corplan consultant pleaded guilty in federal court to paying bribes to two county commissioners in Willacy County in connection with a prison contract there. The two commissioners also pleaded guilty. Corplan wasn’t charged. The next year, Parkey visited the same county to pitch another jail project. He and his team estimated the county would get $8 million within the first seven months of the contract, according to a federal suit filed against the county, Parkey, and others in 2009 by Juan Angel Guerra, then the county’s district attorney. Parkey was dropped from the suit in 2010, and the case was resolved in favor of the county in 2011. “He’s not a poster child,” Parkey says of Guerra. “It is what it is.”

Parkey is now a consultant for Emerald Correctional Management. In August, a group from Emerald visited Anahuac, Texas, to pitch Chambers County commissioners on a deportation processing center that could be used by federal authorities. The deal was to be paid for with taxable bonds. The commissioners voted no. An Emerald spokesman didn’t return calls.

In September, Parkey traveled to Cleveland, Texas, almost 60 miles northwest of Anahuac, where he met with business leaders at the Lions Club, according to a report in the Cleveland Advocate. “Not one tax dollar of yours goes into this,” he told the group.

The bottom line: The IRS is going after counties that issued tax-free bonds to build jails used by federal agencies.

Monday, October 5, 2015

Ransomware: To pay or not to pay

There is no need to tell victims of digital extortion how successful it is. What is needed is a way to help victims respond to the ransom demands.

"Never before in the history of humankind have people across the world been subjected to extortion on a massive scale as they are today."

That introduction to Symantec's August 2015 report The evolution of ransomware (PDF) certainly grabs one's attention. I have been writing articles about ransomware since 2010, and looking back at my 2010 notes I noticed a comment of mine: "Ransom on the internet may not garner much money per incident but patient extortionists can cast a wide net and haul in many innocent victims who have no recourse other than to pay."

I wish I had been wrong; however, evidence offered in the following reports suggest otherwise.

In 2012, close to 3% of victims paid ransom demands. Symantec reported one small-time operator managed to infect 68,000 computers in one month, resulting in potentially $400,000 USD being extorted.

In March 2014, Dell SecureWorks reported CryptoWall earned $34,000 USD in its first month of operation. By August 2014, CryptoWall had earned more than $1.1 million USD.

In June 2015, the FBI's Internet Crime Complaint Center published that 992 CryptoWall-related complaints were filed, and the resulting losses from these cases amounted to more than $18 million USD.

Currently, the going ransom is $300 USD. The two favored payment methods are payment vouchers and bitcoins.

Price sweet spot

Like any business, those running a cyber extortion ring understand the importance of finding the price sweet spot, which is probably why pricing per incident has not changed much since 1989 when ransomware first reared its ugly head.

"Taking inflation into account, 189 US dollars in 1989 is now worth 368 US dollars in 2015," explain the report's authors Kevin Savage, Peter Coogan, and Hon Lau. "Looking at the initial ransomware from various malware families from the start of 2014 to June 2015, we can see the ransom demand has ranged from 21 US dollars up to 700 US dollars, with the average being just over 300 US dollars."

Location affects pricing

Victims' locations are another consideration. The amount of money that can be excised from victims in one country may be way too much to charge victims in a different area of the world. The report mentions, "To tackle the issue of international purchasing power, we can see that the idea of dynamic geographical pricing is employed by some ransomware."

CryptoWall is one such example. The ransomware, using an automated process, alters prices depending on geographical location. When a computer compromised with CryptoWall reports back to the command and control server, the server checks a database, determines what country the IP address is from, alters pricing based on location, and returns the ransom note with an adjusted price to the compromised computer.

Hit the jackpot

Cyber extortionists that focus on businesses cast a smaller and more sophisticated net, but if successful, the dividends are huge. The Symantec report discusses a Forbes article by Thomas Fox-Brewster. In the article, Brewster refers to one particular cyber extortion, mentioning, "Employees at the financial services firm were sent emails from a Gmail account, demanding the firm pay 50,000 US dollars to get their website back. They threatened to increase the price by 10 percent with every passing week."

The tough question

There are myriad articles describing what ransomware is and how to avoid it. All of which means nothing when you are staring at a digital ransom note. Now it's up close and personal.

Do you take the high road and not pay? Supposedly, paying reinforces that digital extortion does indeed work. Authors Savage, Coogan, and Lau have this to say about not paying: "While law enforcement officials will advise victims not to pay the ransom, there are several documented cases where they have paid the extortion demand to get their files back."

The authors mention that both the victims and the extortionists are walking a trust tightrope. Why should the victim trust that access to the data will be returned? The Symantec report suggests one reason: "They (extortionists) realize that without their reputation of being trusted to decrypt the files after the ransom demand is paid, no new victims will pay the ransom demands, which is bad for business."

There is no right or wrong answer

I asked numerous experts what they would do. Dismissing those who say it will never happen to them, responses vacillated evenly between pay and not pay. The sincere answer seems to be, "I will not truly know what to do until it happens to me."

I count myself in that group.

Friday, October 2, 2015

Save these dates / Guarde estas fechas....

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Subscribe to:

Posts (Atom)